August 5, 2024 – Ozon Holdings PLC (hereafter referred to as “we”, “us”, “our”, “Ozon”, “the Company”, or “the Group”) today announces its unaudited financial results for the three and six months ended June 30, 2024.

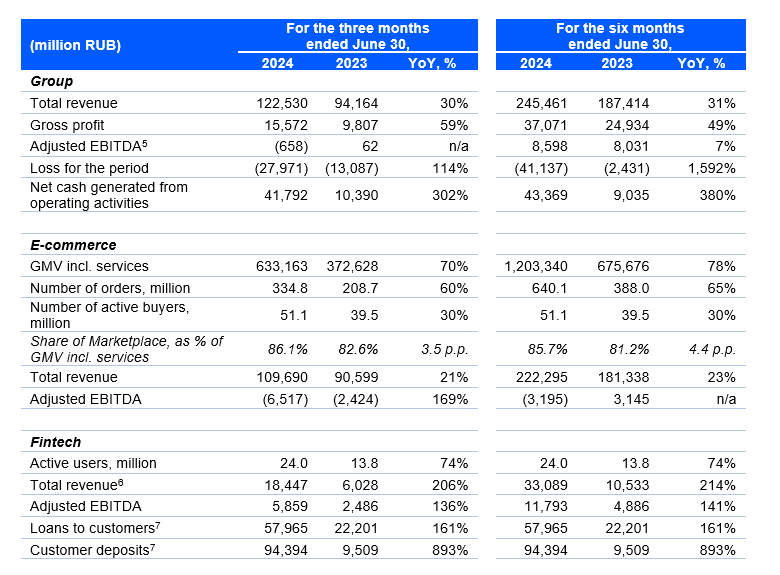

Second-Quarter 2024 Operating and Financial Highlights

Group

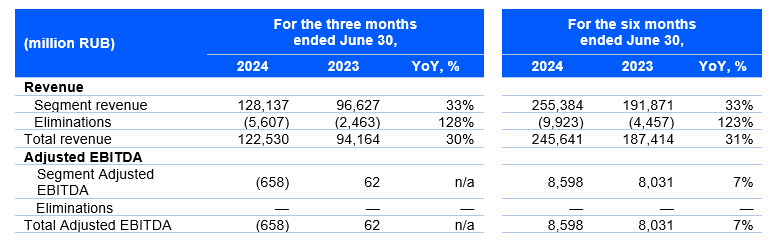

· Total revenue increased by 30% YoY to RUB 122.5 billion, driven by 86% growth in advertising revenue and a fourfold increase in interest revenue in Q2 2024.

· Adjusted EBITDA decreased by RUB 0.7 billion YoY to negative RUB 0.7 billion, due to significant growth investments and unprecedented labor cost inflation, offset by a positive impact from Fintech. Adjusted EBITDA as a percentage of GMV incl. services remained broadly flat YoY.

· Loss for the period was RUB 28.0 billion in Q2 2024, compared with a loss of RUB 13.1 billion in Q2 2023, mainly due to a significant increase in finance costs and higher depreciation and amortization expenses.

· Net cash generated from operating activities increased fourfold YoY to RUB 41.8 billion in Q2 2024, as a result of favorable working capital movements.

E-commerce

· E-commerce revenue increased by 21% YoY to RUB 109.7 billion in Q2 2024, bolstered by strong growth in advertising revenue.

· E-commerce adjusted EBITDA decreased to negative RUB 6.5 billion in Q2 2024, compared with negative RUB 2.4 billion in Q2 2023, due to labor cost inflation and marketing initiatives.

· GMV incl. services increased by 70% YoY to RUB 633.2 billion, despite a high base of 118% YoY growth in Q2 2023. The growth in GMV incl. services was augmented by 60% YoY growth in the number of orders.

· The number of active buyers1 increased by 30% YoY to 51.1 million as of June 30, 2024, and order frequency grew by 40% YoY to 24 orders per year, as a result of our investments in enhancing user experience, including product and delivery.

Fintech

· Fintech revenue increased by 206% YoY to RUB 18.4 billion in Q2 2024, driven by strong growth in both interest and service revenue due to the development of our B2B and B2C credit and transaction product suite.

· Fintech adjusted EBITDA increased by 136% YoY to RUB 5.9 billion, fueled by growth in interest and service revenues.

· Loans to customers2 increased to RUB 58.0 billion as of June 30, 2024, compared with RUB 22.2 billion as of June 30, 2023, as a result of the expansion of our credit operations.

· Customer deposits3 increased significantly to RUB 94.4 billion as of June 30, 2024, compared with RUB 9.5 billion as of June 30, 2023, due to a growing Ozon Card customer base and an increasing number of deposit accounts.

· In Q2 2024, the number of Fintech active users4 increased by 74% YoY to 24.0 million. In addition, our expanded B2C product offering included Ozon Card – the top payment method on our Marketplace, Ozon Installment, deposit and savings accounts and the “cash on card” service. The B2B product suite comprised of loans for business development, cash and settlement services and factoring.

The following table sets forth a summary of the key operating and financial information for the three and six months ended June 30, 2024, and June 30, 2023. The information for the three and six months ended June 30, 2024 and 2023 has not been audited by the Company’s auditors. Since January 1, 2024, following the expansion of our Fintech segment, we have presented interest revenue separately from other types of revenue in the Interim Condensed Consolidated Statements of profit or loss and other comprehensive income. Furthermore, we also presented expected credit losses on Fintech financial assets separately from cost of revenue. We have also introduced other changes to the presentation of the statements of profit or loss and other comprehensive income, the statement of financial position, and statement of cash flows. The corresponding amounts for the three and six months ended June 30, 2023 and as of December 31, 2023 were reclassified accordingly. Please refer to note 2.2 of our Interim Condensed Consolidated Financial Statements for the three and six months ended June 30, 2024.

See also the “Presentation of Financial and Other Information – Use of Non-IFRS Financial Measures” section of this press release for a definition of the non-IFRS measures and a discussion of the limitations of their use, and for reconciliations of the non-IFRS measures to applicable IFRS measures. See the definitions of metrics such as GMV incl. services, number of orders, number of active buyers, share of Marketplace GMV and number of active users of Fintech in the “Presentation of Financial and Other Information – Key Operating Measures” section of this press release.

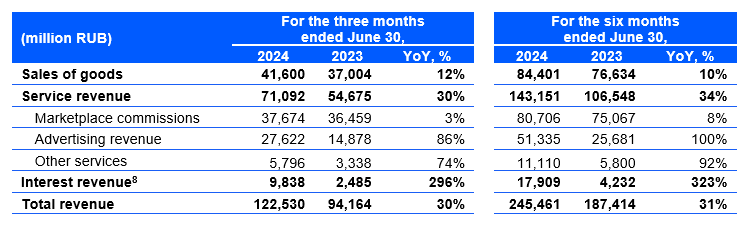

Second-Quarter 2024 Consolidated Financial Highlights

Total revenue increased by 30% YoY, driven by service and interest revenue. Service revenue increased by 30% YoY due to strong growth in advertising revenue. Deceleration in the growth of marketplace commissions was largely attributed to transitioning to an agency model in last- mile delivery and acquiring services from Q4 2023, and additional investments in platform growth.

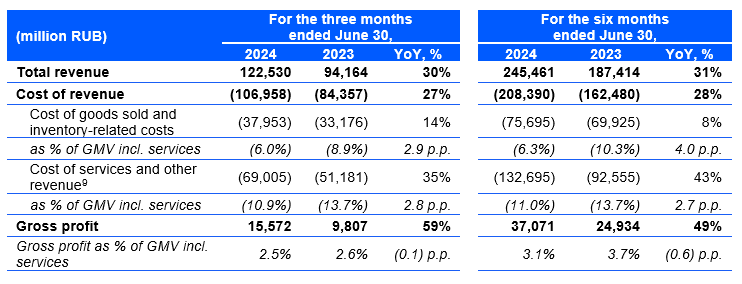

Gross profit increased by 59% YoY in Q2 2024 and remained broadly flat as a percentage of GMV incl. services, despite our growth investments and high labor cost inflation.

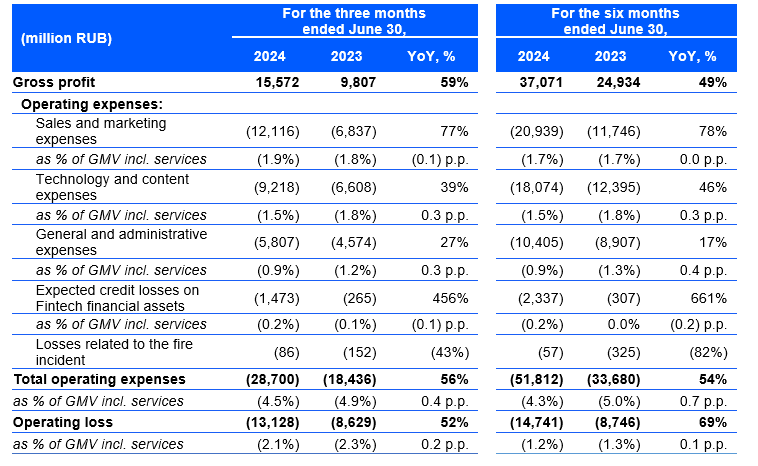

Operating expenses grew by 56% YoY, driven by our marketing and advertising campaigns launched in Q2 2024. Total operating expenses as a percentage of GMV incl. services decreased by 0.4 p.p. YoY to 4.5% in Q2 2024. This was a result of operating leverage and cost discipline, especially in general and administrative expenses. Provision for expected credit losses on Fintech financial assets increased by RUB 1.2 billion YoY to RUB 1.5 billion due to the expansion of Fintech’s credit operations.

Net finance expense more than doubled YoY in Q2 2024, as a result of an increase in our interest-bearing liabilities and higher borrowing costs on our debt linked to the Bank of Russia key rate10. This in part resulted in a RUB 14.9 billion YoY increase in the loss for Q2 2024.

Net cash generated from operating activities increased to RUB 41.8 billion in Q2 2024, compared with RUB 10.4 billion in Q2 2023, as a result of the positive contribution made by Fintech customer deposits, trade payables and liabilities to marketplace sellers and customers.11

Net cash used in investing activities increased by 136% YoY to RUB 16.6 billion, mainly driven by capital expenditures of RUB 17.4 billion in Q2 2024. As of June 30, 2024, our total warehouse footprint has increased by more than 1 million square meters – 65% YoY, and exceeded 2.8 million square meters.

Net cash used in financing activities increased by 86% YoY to RUB 24.0 billion in Q2 2024, primarily as a result of repayment of RUB 21.7 billion of short-term borrowings.

Cash and cash equivalents amounted to RUB 164.7 billion as of June 30, 2024 and included RUB 113.3 billion held by credit institutions within the Fintech segment, compared with RUB 165.7 billion and RUB 81.4 billion as of March 31, 2024, respectively.

Full-Year 2024 Outlook

Based on the current trends and outlook, Ozon expects its GMV incl. services to grow by approximately 70% in FY 2024 compared with FY 2023, and adjusted EBITDA to be positive for FY 2024.12

Interim Condensed Consolidated Statements are available here.

Risks and Uncertainties Related to the Current Environment

As the global and economic consequences of the current geopolitical crisis continue to evolve in a manner that is unpredictable and beyond the Company’s control, it is difficult to accurately assess the full impact of this crisis on the Company’s business and the results of its operations.

The United States, the European Union, the United Kingdom and other jurisdictions imposed severe sanctions targeting companies and businesspersons with links to Russia, as well as export and import restrictions. In response, Russia designated a number of states, including the United States, all European Union member states and the United Kingdom, as unfriendly and introduced a number of economic measures in connection with their actions, as well as economic measures aimed at ensuring financial stability in Russia. These sanctions, along with regulatory countermeasures taken by the Russian authorities, have had a significant, and in many cases unprecedented, impact on companies operating in Russia.

At various times over the last two decades (and in some cases to this day), the Russian economy has experienced significant GDP volatility, high levels of inflation, increases in, or high, interest rates, sudden price drop in oil and other natural resources, and instability in the local currency market.

Please refer to our Annual Report for the year ended December 31, 2023 and our Interim Condensed Consolidated Financial Statements for the three and six months ended June 30, 2024, and other public disclosures concerning factors that could impact the Company’s business and the results of operations.

Disclaimer

This press release contains forward-looking statements that reflect the current views of Ozon Holdings PLC (“we”, “our”, “us”, or the “Company”) about future events and financial performance. All statements contained in this press release that do not relate to matters of historical fact should be considered forward-looking statements and are applicable only as of the date on which they are made.

These forward-looking statements are based on management’s current expectations. However, it is not possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements we may make. These statements are neither promises nor guarantees but involve known and unknown risks, uncertainties and other important factors and circumstances that may cause Ozon’s actual results, performance or achievements to be materially different from the expectations expressed or implied by the forward-looking statements. Such factors include conditions in the relevant capital markets, negative global economic conditions, the ongoing geopolitical crisis, sanctions and governmental measures imposed in various jurisdictions in which we operate and other developments negatively impacting Ozon’s business or unfavorable legislative or regulatory developments. We therefore caution you against relying on these forward-looking statements, and we qualify all of our forward-looking statements with these cautionary statements. Please refer to our Annual Report for the year ended December 31, 2023 and our Interim Condensed Consolidated Financial Statements for the three and six months ended June 30, 2024, as well as other public disclosures of the Company concerning factors that could cause actual results to differ materially from those described in our forward-looking statements.

These and other important factors could cause actual results to differ materially from those indicated by the forward-looking statements made in this press release. Any such forward-looking statements represent management’s estimates as of the date of this press release. While Ozon may elect to update such forward-looking statements at some point in the future, Ozon disclaims any obligation to do so, even if subsequent events cause its views to change. These forward-looking statements should not be relied upon as representing Ozon’s views as of any date subsequent to the date of this press release.

This press release includes “Adjusted EBITDA,” a financial measure not presented in accordance with IFRS. This financial measure is not a measure of financial performance or liquidity in accordance with IFRS and may exclude items that are significant in understanding and assessing our financial results. Therefore, this measure should not be considered in isolation or as an alternative to loss for the period or other measures of profitability, liquidity or performance under IFRS. You should be aware that the Company’s presentation of this measure may not be comparable to similarly named measures used by other companies, which may be defined and calculated differently. See “Presentation of Financial and Other Information – Use of Non-IFRS Financial Measures” in this press release for a reconciliation of this non-IFRS measure to the most directly comparable IFRS measure.

This press release includes information for the three and six months ended June 30, 2024, and June 30, 2023. The information for the three and six months ended June 30, 2024 and 2023 has not been audited by the Company’s auditors. The information disclosed in this press release is based on currently available information.

The trademarks included herein are the property of the owners thereof and are used for reference purposes only. Such use should not be construed as an endorsement of the products or services of the Company.

Presentation of Financial and Other Information

Key Operating Measures

Certain parts of this press release contain our key operating measures, including, among others, gross merchandise value including revenue from services (“GMV incl. services”), share of our online marketplace (our “Marketplace”) GMV (“Share of Marketplace GMV”), number of orders, number of active buyers and number of active sellers. We define:

· GMV incl. services (gross merchandise value including revenue from services) as the total value of orders processed through our platform, as well as revenue from services to our buyers, sellers and other customers, such as delivery, advertising and other services. GMV incl. services is inclusive of value-added taxes, net of discounts, returns and cancellations. GMV incl. services does not represent revenue earned by us. GMV incl. services does not include interest revenue earned by our Fintech segment, travel ticketing and hotel booking commissions, other related service revenues or the value of the respective orders processed.

· Share of Marketplace GMV as the total value of orders processed through our Marketplace, inclusive of value-added taxes, net of discounts, returns and cancellations, divided by GMV incl. services in a given period. Share of Marketplace GMV includes only the value of goods processed through our platform and does not include services revenue.

· Capital expenditures as payments for purchase of property, plant and equipment and intangible assets.

· Number of orders as the total number of orders delivered in a given period, net of returns and cancellations.

· Number of active buyers as the number of unique buyers who placed an order on our platform within the 12-month period preceding the relevant date, net of returns and cancellations.

· Number of active sellers as the number of unique merchants who made a sale on our Marketplace within the 12-month period preceding the relevant date.

· Number of Fintech active users as the number of unique users that met at least one of the following conditions as of the reporting date:

– the user had a balance in their accounts exceeding 10,000 RUB on any date in the previous 3 months;

– the user had loan debt on any date in the previous 3 months;

– the user had a paid Ozon Premium subscription on any date in the previous 3 months;

– the user had a paid Ozon Bank Account (B2B) subscription on any date in the previous 3 months;

– the user completed at least one transaction in the previous 3 months;

– the user used “Flexible Payment Plan” at least once for the previous 3 months.

Use of Non-IFRS Financial Measures

We report under International Financial Reporting Standards (“IFRS”) as adopted by the International Accounting Standards Board (“IASB”). We present our consolidated financial statements in Russian Rubles.

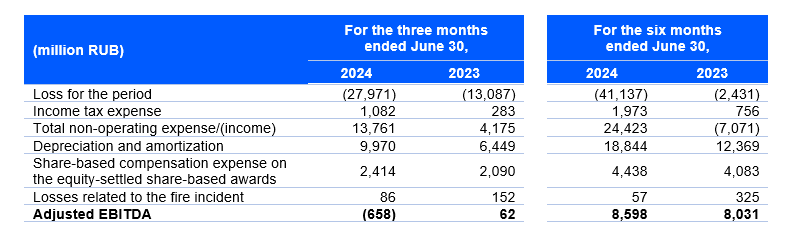

Certain parts of this press release refer to “Adjusted EBITDA,” which is a non-IFRS financial measure defined as follows:

· Adjusted EBITDA is a non-IFRS financial measure that we calculate as (loss)/profit for the period before income tax expense/(benefit), total non-operating expense/(income), depreciation and amortization, share-based compensation expense on the equity-settled share-based awards and losses related to the fire incident. Adjusted EBITDA is not adjusted for the interest revenue and interest expenses related to the core activities of our Fintech segment. Adjusted EBITDA is disclosed here and elsewhere in this press release to provide investors with additional information regarding the results of our operations.

Adjusted EBITDA is a supplemental non-IFRS financial measure that is not required by, or presented in accordance with, IFRS. We have included Adjusted EBITDA in this press release because it is a key measure used by our management and Board of Directors to evaluate our operating performance, generate future operating plans and make strategic decisions regarding the allocation of capital. In particular, the exclusion of certain expenses in calculating Adjusted EBITDA facilitates operating performance comparability across reporting periods by removing the effect of non-cash expenses, non-operating income/(expense) and material non-recurring items. Accordingly, we believe that Adjusted EBITDA provides useful information to investors in understanding and evaluating our operating results in the same manner as our management and Board of Directors.

We believe it is useful to exclude non-cash charges, such as depreciation and amortization and equity-settled share-based compensation expense, from our Adjusted EBITDA because the amount of such expenses in any specific period may not directly correlate to the underlying performance of our business operations. We believe it is useful to exclude income tax benefit/(expense) and total non-operating income/(expense), as these items are not components of our core business operations. We believe it is useful to exclude losses related to the fire incident, as these losses relate to a material non-recurring event, which is not indicative of our performance in the future. Adjusted EBITDA has limitations as a financial measure, and you should not consider it in isolation or as a substitute for loss for the period as a profit measure or other analysis of our results as reported under IFRS. Some of these limitations are:

· although depreciation and amortization are non-cash charges, the assets being depreciated and amortized may have to be replaced in the future, and Adjusted EBITDA does not reflect capital expenditure requirements for such replacements or for new capital expenditures;

· Adjusted EBITDA does not reflect share-based compensation on the equity-settled share-based awards, which has been, and will continue to be for the foreseeable future, a recurring expense in our business and an important part of our compensation strategy;

· although share-based compensation expense on the equity-settled share-based awards are non-cash charges, we cannot assure you that we will not perform a buyback or other similar transaction that leads to a cash outflow;

· although losses related to the fire incident are the result of a material non-recurring event, there is no assurance that such or similar losses will not recur in the future; and

· other companies, including companies in our industry, may calculate Adjusted EBITDA differently, which reduces its usefulness as a comparative measure.

Because of these limitations, you should consider Adjusted EBITDA alongside other financial performance measures, including various cash flow metrics, operating loss, loss for the period and our other IFRS results.

The following table presents a reconciliation of loss for the period to Adjusted EBITDA for each of the periods indicated.

Eliminations

Our operating segments rely on services and products of other operating segments, for which they pay various service fees and compensations. Such service fees and compensations represent intersegment transactions, which are included in revenues of the reportable segments presented in this press release. Intersegment revenues are eliminated upon consolidation within the eliminations line item below.

About Ozon

Ozon is a multi-category e-commerce platform operating in Russia, Belarus, Kazakhstan, Kyrgyzstan, Armenia, Uzbekistan, China and Turkey. Our fulfillment and delivery infrastructure enables us to provide our customers with fast and convenient delivery via couriers, pickup points or parcel lockers. Our extensive logistics footprint and fast-developing marketplace platform help entrepreneurs sell their products across 11 time zones and offer our customers a wide selection of goods across multiple product categories. Ozon is committed to expanding its value-added services, including in fintech and other verticals such as Ozon Fresh online grocery delivery. For more information, please visit https://corp.ozon.com.

Contacts

Investor Relations

Press Office

pr@ozon.ru1 See the definition of active buyers in the “Presentation of Financial and Other Information – Key Operating Measures” section of this Release.

2 Loans to customers include current and non-current loans to legal entities, individual entrepreneurs and individuals, net of allowance for expected credit losses.

3 Customer deposits include outstanding balances on current accounts and term deposits from customers.

4 See the definition of Fintech active users in the “Presentation of Financial and Other Information – Key Operating Measures” section of this Release.

5 Adjusted EBITDA is a non-IFRS financial measure that is defined in the “Presentation of Financial and Other Information – Key Operating Measures” section of this press release.

6 Total Fintech revenue includes interest and service revenues on credit products for B2B and B2C customers, flexible payment schedule and factoring services for sellers, revenues from payment processing services, premium subscription, cash and settlement services and bank cards services.

7 As of June 30, 2023 and 2024.

8 Interest revenue includes revenues from interest and interest-like commissions on Fintech’s financial assets, which are accounted for at amortized costs using the effective interest method.

9 Cost of services and other revenue mainly includes fulfillment and delivery costs, fees for cash collection and cost of financial services revenue.

10 The key rate increased from 7.5% as of March 31, 2023, to 16.0% as of June 30, 2024.

11 As of June 30, 2024, we have revisited the presentation of statement of financial position to present its payables to third-party sellers on the marketplace platform and the marketplace customer advances and contract liabilities in a single line item “Liabilities to marketplace sellers and customers”. Consequently, the “Trade and other payables” line item primarily includes amounts payable to our suppliers and other similar items.

12 The forward-looking statements below reflect Ozon’s expectations as of August 5, 2024, and could be subject to change. In addition, they are subject to inherent risks that we are not able to control — for example, any changes to political and economic conditions, either globally or in the regions in which we operate.