April 9, 2024 – Ozon Holdings PLC (MOEX, AIX: “OZON,” hereafter referred to as “we,” “us,” “our,” “Ozon,” the “Company,” the “Group”) today announced its unaudited financial results for the fourth quarter and audited financial results for the full year ended December 31, 2023.

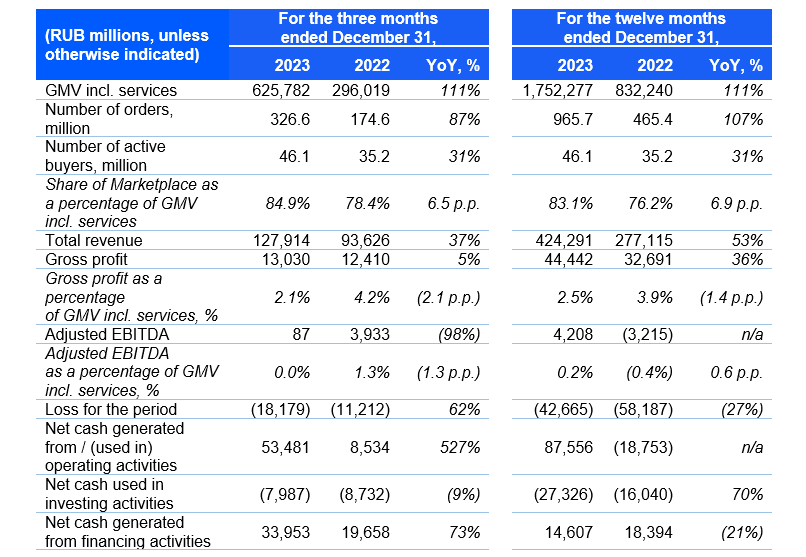

Fourth-Quarter and Full-Year 2023 Operating and Financial Highlights· GMV incl. services rose 111% year-on-year in Q4 2023, compared with 67% year-on-year in Q4 2022, mostly driven by a significant increase in the number of orders and higher average order value. GMV incl. services grew by 111% year-on-year to RUB 1,752.3 billion in FY 2023, and exceeded our guidance of 90%–100% growth. FY 2023 GMV incl. services was bolstered by a 130% increase in our Marketplace GMV.

· Total revenue increased by 37% and 53% year-on-year in Q4 2023 and in FY 2023, respectively, driven by marketplace commissions and rapid growth in revenue from advertising and financial services.

· Adjusted EBITDA was positive RUB 0.1 billion in Q4 2023 and positive RUB 4.2 billion for FY 2023. Despite growth investment, adjusted EBITDA as a percentage of GMV incl. services improved by 0.6 p.p. year-on-year to 0.2% as a result of cost discipline, the operating leverage effect and greater monetization of our advertising and fintech services for FY 2023.

· Loss for the period was RUB 18.2 billion in Q4 2023, compared with RUB 11.2 billion in Q4 2022, due to strategic growth investments, rising labor cost inflation and rising finance expenses. The FY 2023 net loss decreased by RUB 15.5 billion year-on-year to RUB 42.7 billion as a result of higher gross profit, as well as the recognition of a gain related to the restructuring and settlement of convertible bonds in FY 2023, and a one-off loss related to the fire incident in FY 2022.

· Net cash generated from operating activities increased by RUB 45.0 billion year-on-year to RUB 53.5 billion in Q4 2023, largely driven by a greater positive contribution from working capital and our fast-growing financial services. Our operating cash flow for FY 2023 was positive RUB 87.6 billion, marking a significant improvement compared with negative RUB 18.8 billion for FY 2022.

Full-Year 2024 Outlook

Based on the current trends and outlook, Ozon expects its GMV incl. services to grow by approximately 70% in FY 2024 compared with FY 2023, and adjusted EBITDA to be positive for FY 20241

The following table sets forth a summary of the key operating and financial information for the three and twelve months ended December 31, 2023, and December 31, 2022. The information for the three months ended December 31, 2023, and December 31, 2022, has not been audited or reviewed by the Company’s auditors and should be read in conjunction with our consolidated financial statements for the years ended December 31, 2023, 2022 and 2021. From January 1, 2023, we revised the presentation of our statement of profit or loss and other comprehensive income as described in note 2.4, “Changes in Presentation and Reclassifications,” to Ozon Holdings PLC’s consolidated financial statements for the years ended December 31, 2023, 2022 and 2021. The comparative information for the three and twelve months ended December 31, 2022, has been reclassified to comply with the revised presentation. See also the “Presentation of Financial and Other Information – Use of Non-IFRS Financial Measures” section of this press release for a definition of the non-IFRS measures and a discussion of the limitations of their use, and for reconciliations of the non-IFRS measures to the applicable IFRS measures. See the definitions of metrics such as GMV incl. services, number of orders, number of active buyers and share of Marketplace GMV in the “Key Operating Measures” section of this press release.

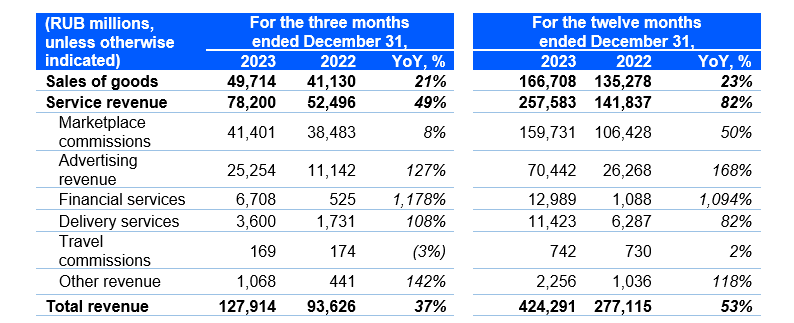

Total revenue increased by 37% and 53% year-on-year in Q4 2023 and FY 2023, respectively. By October 2023, we completed the transition to an agency model for the majority of third-party services rendered to sellers. As a result, our revenues from such services were recognized net of the costs of third-party service providers, which resulted in a decrease in our reported net revenue with a corresponding decrease in cost of revenue and no change to gross profit.

· Revenue from marketplace commissions increased by 8% and 50% year-on-year in Q4 2023 and FY 2023, respectively. The deceleration of year-on-year growth in our marketplace commissions revenue in Q4 2023 compared with the previous quarters (62% in Q3 2023 and 58% in Q2 2023) was mainly associated with the deployment of strategic investments in platform expansion and the transition to the agency model for the last mile and payment processing services. Our growth investments have been bearing fruit, as Ozon Marketplace GMV increased by 129% year-on-year in Q4 2023.

· Advertising revenue increased by 127% year-on-year to RUB 25.3 billion in Q4 2023 and by 168% year-on-year to RUB 70.4 billion for FY 2023, as we introduced new advertising products, and more sellers utilized our advertising services.

· Revenue from financial services grew more than tenfold in Q4 and FY 2023 compared with the previous year, as Ozon Fintech continued to focus on expansion of its user base and product development.

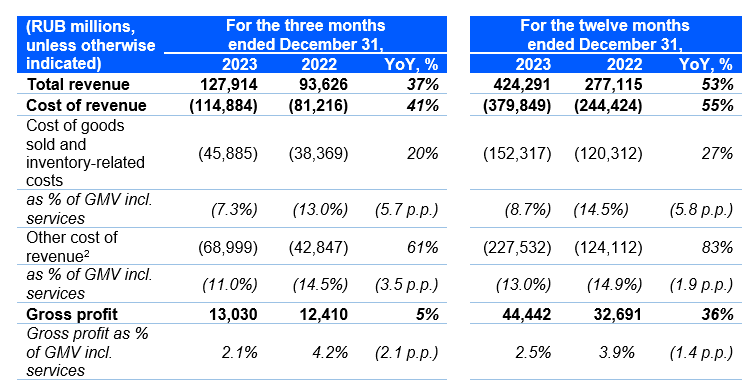

From January 1, 2023, as described in note 2.4, “Changes in Presentation and Reclassifications,” to Ozon Holdings PLC’s consolidated financial statements for the years ended December 31, 2023, 2022 and 2021, fulfillment and delivery expenses and cost of sales are presented as cost of revenue, following continued fast growth in our marketplace operations. Accordingly, we changed the definition of gross profit from total revenue less cost of sales in a given period to total revenue less cost of revenue in a given period.

Gross profit increased by 5% year-on-year and by 36% year-on-year in Q4 2023 and FY 2023, respectively. Gross profit as a percentage of GMV incl. services decreased by 2.1 p.p. year-on-year to 2.1% and by 1.4 p.p. to 2.5% in Q4 2023 and FY 2023, respectively. The contraction of gross profit margin stemmed from our continued strategic growth investments in platform development and rising fulfillment and delivery costs due to continued expansion of our logistics infrastructure and a tighter labor market in Russia in H2 2023. Our total warehouse footprint increased by 87% year-on-year and exceeded 2.5 million square meters as of December 31, 2023.

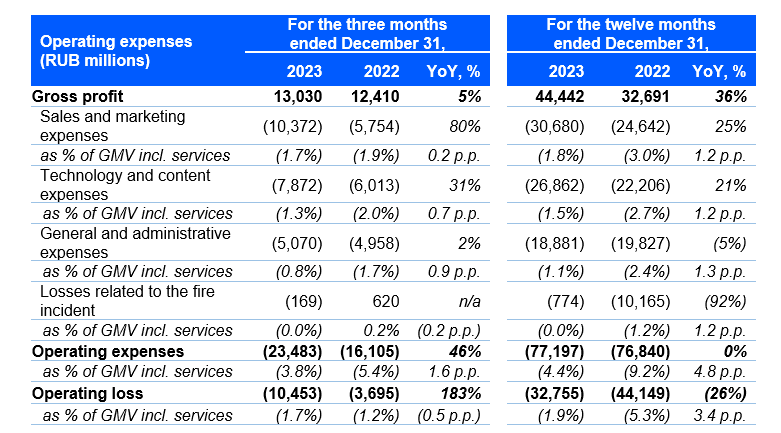

Operating expenses grew by 46% year-on-year in Q4 2023, driven by increased sales and marketing expenses primarily related to the expansion of Ozon Fintech, Ozon Global and Ozon CIS operations. Total operating expenses amounted to RUB 77.2 billion for FY 2023 and remained broadly flat compared with FY 2022. Total operating expenses as a percentage of GMV incl. services decreased by 1.6 p.p. year-on-year to 3.8% in Q4 2023 and by 4.8 p.p. year-on-year to 4.4% for FY 2023, due to strong GMV growth and disciplined cost control resulting in improved operating leverage. Gross margin contraction contributed to an operating loss in Q4 2023.

For the year ended December 31, 2023, our net finance expenses decreased by RUB 11.4 billion year-on-year to RUB 5.4 billion due to the recognition of a one-off RUB 18.5 billion gain related to the restructuring of convertible bonds in Q1 2023. Our interest expense increased significantly year-on-year to RUB 8.1 billion in Q4 2023 and to RUB 22.7 billion for FY 2023, driven by growth in interest-bearing liabilities and the impact of interest rate increases on our cost of debt, which is linked to the Bank of Russia key rate. As of December 31, 2023, the key rate increased to 16.0%, compared with 7.5% as of December 31, 2022.

Loss for the period was RUB 18.2 billion in Q4 2023, compared with RUB 11.2 billion in Q4 2022 primarily due to the impact of strategic growth investments, rising labor cost inflation and higher finance costs. Loss for FY 2023 decreased to RUB 42.7 billion, compared with RUB 58.2 billion for the previous year, as a result of a higher gross profit, as well as the recognition of the one-off gain related to the restructuring and settlement of convertible bonds in FY 2023, and a one-off loss related to the fire incident in FY 2022.

Net cash generated from operating activities increased sixfold year-on-year to RUB 53.5 billion in Q4 2023 and reached RUB 87.6 billion for FY 2023, a marked improvement compared with net cash generated from operating activities of RUB 8.5 billion and net cash used in operating activities of RUB 18.8 billion for Q4 2022 and FY 2022, respectively. Cash generation was underpinned by the growing scale of Ozon Marketplace operations, which led to growth in accounts payable, and an increase in customer deposits as a result of Ozon Fintech expansion.

Net cash used in investing activities decreased by 9% year-on-year to RUB 8.0 billion in Q4 2023, as the planned increase in capital expenditure was offset by higher interest inflows on our bank deposits and other investments. FY 2023 net cash used in investing activities increased to RUB 27.3 billion from RUB 16.0 billion for FY 2022 as a result of a return of deposits in 2022, which was partially offset by lower capital expenditure. Capital expenditures decreased by 17% year-on-year to RUB 29.5 billion.

Net cash generated from financing activities increased by 73% year-on-year to RUB 34.0 billion in Q4 2023 as a result of drawdowns from our credit facilities. Financing cash flow for FY 2023 decreased by 21% year-on-year to RUB 14.6 billion primarily due to the early settlement of our convertible bonds due 2026.

Cash and cash equivalents amounted to RUB 169.8 billion as of December 31, 2023, compared with RUB 92.7 billion as of September 30, 2023, and RUB 90.5 billion as of December 31, 2022.

Business and Corporate Developments

· Ozon E-Commerce: the number of orders more than doubled to 966 million for FY 2023. Order growth was augmented by a rising order frequency and an expanding customer base. Order frequency per active buyer increased by 59% year-on-year and reached a milestone of 21 orders per year as of December 31, 2023, marking a fourfold increase in three years. The number of active buyers increased by 31% year-on-year to 46.1 million in Q4 2023, as 11 million new users placed an order on our platform over the course of 2023.

· Ozon Fintech continued to invest in the development of a wider range of financial products for our B2C and B2B segments to cater to more of our customers’ needs and to improve the user experience. Our Flexible Payment Plan was the top B2B fintech product in 2023, used by over 75,000 Ozon sellers as of December 31, 2023. In H2 2023, Ozon Fintech promoted its cash and settlement services for sole traders and small and medium-sized enterprises. Our flagship B2C product, the Ozon Card, remained the most popular payment method on our platform, with more than 33 million user accounts as of December 31, 2023. In January 2024, Ozon Bank obtained an A- credit rating from the National Rating Agency, which reflects the bank’s stable financial position and strong profitability.

· Ozon Global continued to focus on enhancing the cross-border experience for our customers and sellers. Since 2021, Ozon Global has established itself as a well-known and trustworthy B2B brand in China, and Forbes China included it among its top 30 companies promoting China’s development in 2023.

· Ozon CIS continued to expand its operations in CIS markets and to improve its logistics efficiency. In Q4 2023, we launched sales in Uzbekistan, and we plan to develop a local logistics infrastructure in the Uzbek market. In 2023, Ozon entered into a partnership with the Armenian post service Ipost, which should enhance the local customer experience.

Risks and Uncertainties Related to the Current Environment

As the global and economic impacts of the current geopolitical crisis continue to evolve in a manner that is unpredictable and beyond the Company’s control, it is difficult to accurately assess the full impact of this crisis on the Company’s business and the results of its operations.

The United States, the European Union, the United Kingdom and other jurisdictions imposed severe sanctions targeting companies and businesspersons related to Russia, as well as export and import restrictions. In response, Russia identified a number of states, including the United States, all European Union member states and the United Kingdom, as unfriendly and introduced a number of economic measures in connection with their actions, as well as economic measures aimed at ensuring financial stability in Russia. These sanctions, along with regulatory countermeasures taken by the Russian authorities, have had a significant, and in many cases unprecedented, impact on companies operating in Russia.

Over the last two decades, the Russian economy has experienced or continues to experience at various times significant volatility in its GDP, high levels of inflation, increases in, or high, interest rates, sudden price declines in oil and other natural resources and instability in the local currency market.

Please refer to our Annual Report on Form 20-F for the year ended December 31, 2022 and other public disclosures concerning factors that could impact the Company’s business and the results of operations.

Consolidated Financial Statements are available here.

About Ozon

Ozon is a multi-category e-commerce platform operating in Russia, Belarus, Kazakhstan, Kyrgyzstan, Armenia, Uzbekistan, China and Turkey. Our fulfillment and delivery infrastructure enables us to provide our customers with fast and convenient delivery via couriers, pickup points or parcel lockers. Our extensive logistics footprint and fast-developing marketplace platform help entrepreneurs to sell their products across 11 time zones and offer our customers a wide selection of goods across multiple product categories. Ozon is committed to expanding its value-added services, including fintech and other verticals such as Ozon Fresh online grocery delivery. For more information, please visit https://corp.ozon.com.

Contacts

Investor Relations

Press Office

Disclaimer

This press release contains forward-looking statements that reflect the current views of Ozon Holdings PLC (“we,” “our,” “us” or the “Company”) about future events and financial performance. All statements contained in this press release that do not relate to matters of historical fact should be considered forward-looking statements.

These forward-looking statements are based on management’s current expectations. However, it is not possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements we may make. These statements are neither promises nor guarantees but involve known and unknown risks, uncertainties and other important factors and circumstances that may cause Ozon’s actual results, performance or achievements to be materially different from its expectations expressed or implied by the forward-looking statements, including conditions in the relevant capital markets, negative global economic conditions, the ongoing geopolitical crisis, sanctions and governmental measures imposed in various jurisdictions in which we operate and other negative developments in Ozon’s business or unfavorable legislative or regulatory developments. We caution you therefore against relying on these forward-looking statements, and we qualify all of our forward-looking statements by these cautionary statements. Please refer to our Annual Report on Form 20-F for the year ended December 31, 2022 and other public disclosures of the Company concerning factors that could cause actual results to differ materially from those described in our forward-looking statements.

These and other important factors could cause actual results to differ materially from those indicated by the forward-looking statements made in this press release. Any such forward-looking statements represent management’s estimates as of the date of this press release. While Ozon may elect to update such forward-looking statements at some point in the future, Ozon disclaims any obligation to do so, even if subsequent events cause its views to change. These forward-looking statements should not be relied upon as representing Ozon’s views as of any date subsequent to the date of this press release.

This press release includes “Adjusted EBITDA,” a financial measure not presented in accordance with IFRS. This financial measure is not a measure of financial performance or liquidity in accordance with IFRS and may exclude items that are significant in understanding and assessing our financial results. Therefore, this measure should not be considered in isolation or as an alternative to loss for the period or other measures of profitability, liquidity or performance under IFRS. You should be aware that the Company’s presentation of this measure may not be comparable to similarly named measures used by other companies, which may be defined and calculated differently. See “Presentation of Financial and Other Information – Use of Non-IFRS Financial Measures” in this press release for a reconciliation of this non-IFRS measure to the most directly comparable IFRS measure.

This press release includes financial information for the three and twelve months ended December 31, 2023 and 2022. The quarterly information has not been audited by the Company’s auditors.

The trademarks included herein are the property of the owners thereof and are used for reference purposes only. Such use should not be construed as an endorsement of the products or services of the Company.

1 The forward-looking statements below reflect Ozon’s expectations as of April 9, 2024, and could be subject to change, and they involve inherent risks that we are not able to control—for example, any changes to political and economic conditions globally as well as in our regions of operations.

2 Other cost of revenue mainly includes fulfillment and delivery costs, fees for cash collection and cost of financial services’ revenue.