April 6, 2023 – Ozon Holdings PLC (NASDAQ and MOEX:

“OZON”, hereafter referred to as “we”, “us”, “our”, “Ozon” or the “Company”)

announces its unaudited financial results for the fourth quarter and the full year-ended

December 31, 2022.

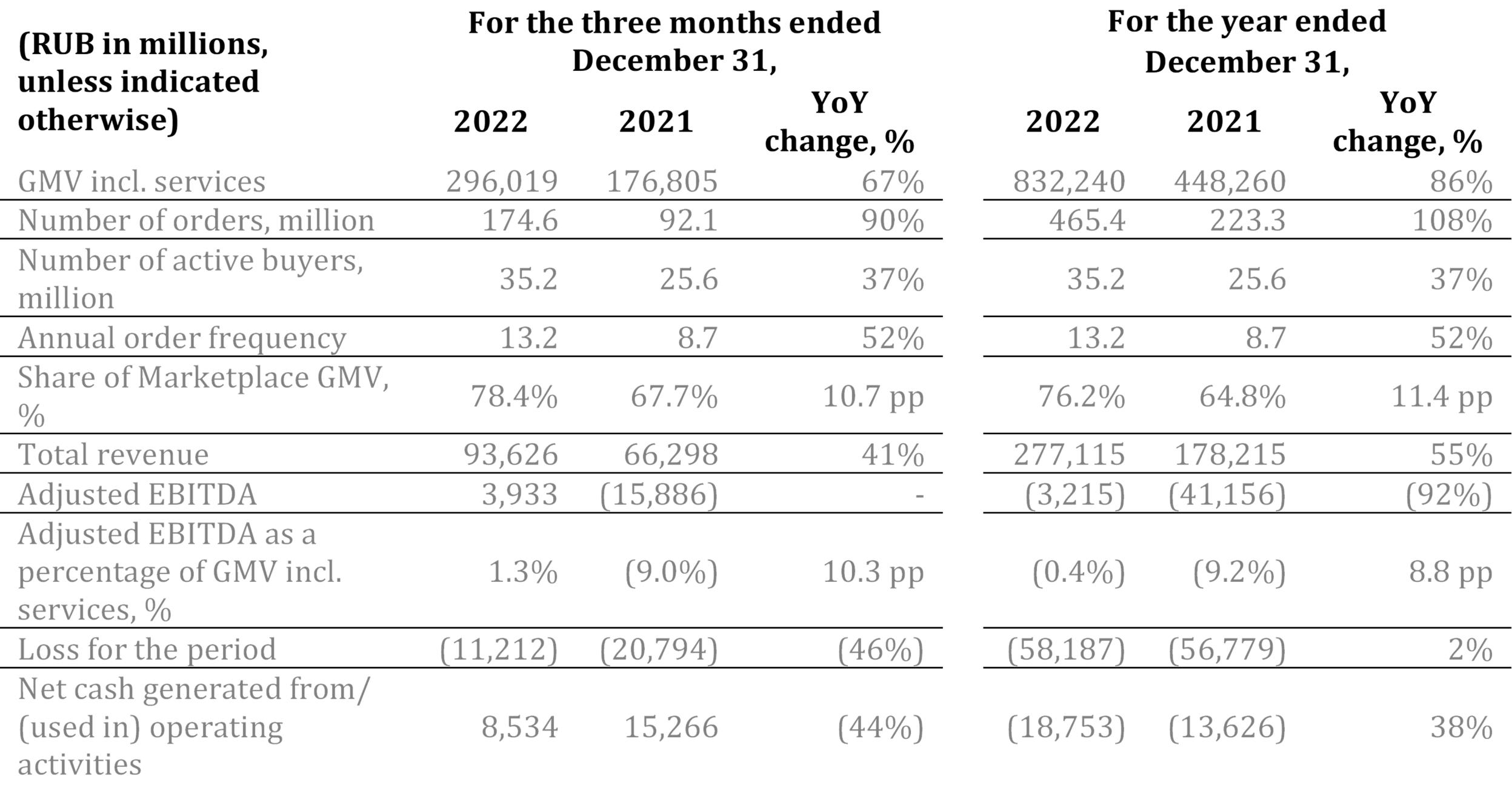

- GMV incl. services increased by 67% year-on-year to RUB 296.0 billion in Q4 2022 boosted by Ozon Marketplace (3P) GMV nearly doubling. In the full-year 2022 our GMV incl. services grew by 86% year-on-year to RUB 832.2 billion, as the number of orders more than doubled to 465 million bolstered by a larger customer base and a rising order frequency, which reached 13.2 orders per active customer per annum. Number of active buyers rose by 9.6 million to 35.2 million in 2022, while number of active sellers increased by more than 2.5 times year-on-year and exceeded 230 thousand. Effective logistics operations underpin our growth. Ozon’s total warehouse footprint expanded by 36% year-on-year and reached 1.4 million square meters as of December 31, 2022.

- Total revenue increase of 41% and 55% year-on-year in Q4 2022 and full-year 2022, respectively, was augmented by growth in our service revenues of 123% year-on-year in Q4 2022 and 147% in the full-year 2022 which stemmed from growth in 3P GMV growth coupled with the rising take rate1, reinforced by advertising revenue almost tripling.

- Adjusted EBITDA was positive for the third consecutive quarter and reached RUB 3.9 billion in Q4 2022 mainly due to the increase in revenue, in particular service revenue, optimization of fulfilment and delivery expenses and a reduction of our sales and marketing costs. Adjusted EBITDA improved by 10.3 p.p. to 1.3% as a percentage of GMV incl. services in Q4 2022 and improved sequentially by 0.4 p.p. compared to Q3 2022.

- Loss for the period decreased significantly year-on-year to RUB 11.2 billion in Q4 2022 and remained broadly flat at RUB 58.2 billion for the full-year 2022, despite a one-off operating expense of RUB 10.2 billion resulting from a fire incident at our fulfillment center in the Moscow region in August 2022.

- Net Cash Generated from Operating Activities was positive and reached RUB 8.5 billion in Q4 2022. A reduction compared to RUB 15.3 billion generated in Q4 2021 was largely attributed to a lower contribution from accounts payable and a greater cash outflow related to inventory purchases.

- Cash, cash equivalents and short-term bank deposits amounted to RUB 90.5 billion (an equivalent of 1.3 billion in USD terms2) as of December 31, 2022.

Summary Table: Key

Operating and Financial Metrics

Note that Adjusted EBITDA

is non-IFRS financial measure. See “Presentation of Financial and Other

Information” section of this press release for a definition of such non-IFRS

measures, a discussion of the limitations on their use and reconciliations of

the non-IFRS measures to the applicable IFRS measures. See the definitions of

GMV incl. services, number of orders, number of active buyers, number of active

sellers and Share of Marketplace GMV in “Other Key Operating Measures” section

of this press release.

This

press release includes information for the three months and twelve months ended

December 31, 2022 and December 31, 2021. The information for the three months

and twelve months ended December 31, 2022, and the three months ended December

31, 2021 has not been audited or reviewed by the Company’s auditors.

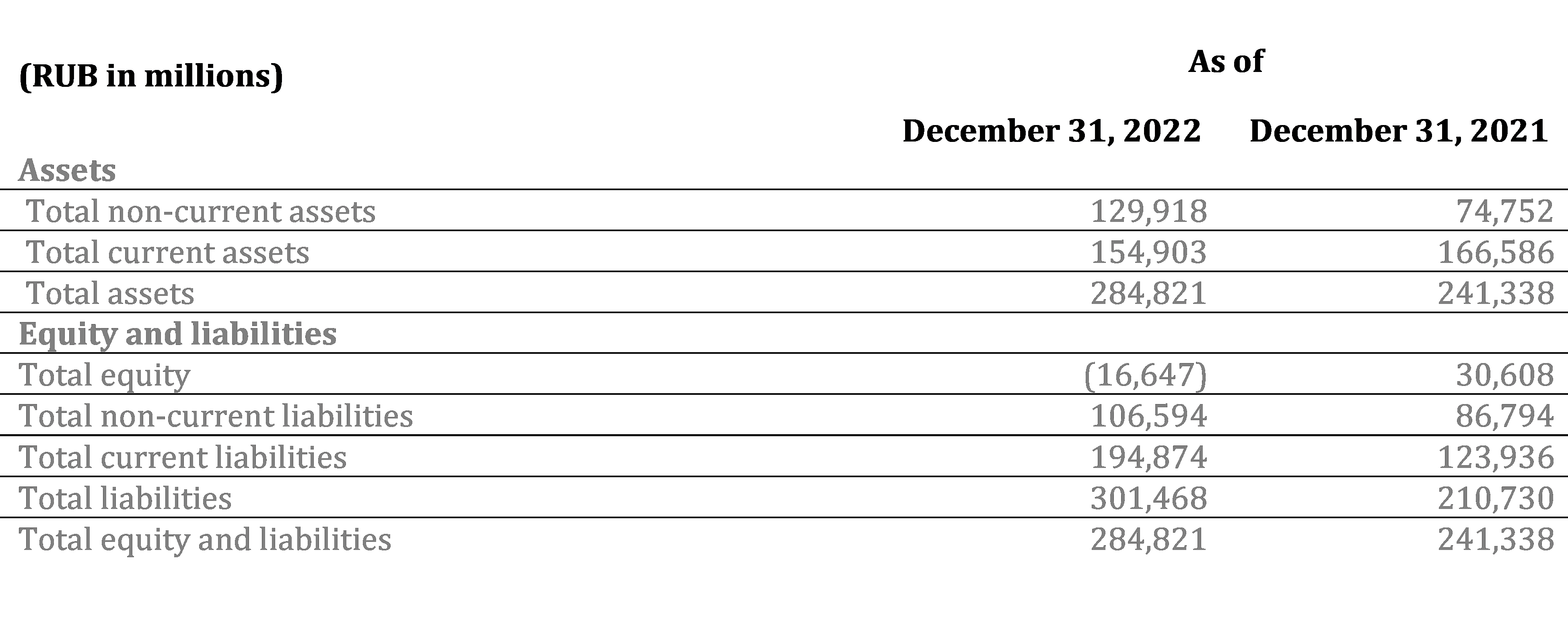

Summary Table: Unaudited

Consolidated Statement of Financial Position Data

About OZON

Ozon is a multi-category e-commerce platform operating in Russia, Belarus

and Kazakhstan. Its fulfillment infrastructure and delivery network enables

Ozon to provide fast and convenient delivery via couriers, pick-up points or

parcel lockers. Its extensive logistics footprint and fast-developing

marketplace platform allow thousands of entrepreneurs to sell their products

across Russia’s 11 time zones and offer millions of customers one of the widest

selections of goods across multiple product categories. Ozon actively seeks to expand its value-added services such as fintech

and other new verticals such as Ozon fresh online grocery delivery. For more

information, please visit https://corp.ozon.com/.

Contacts

Investor Relations

Press Office

1 Take rate is Marketplace

commission as a percentage of 3P GMV in a given period.

2 The USD equivalent was calculated as RUB

amounts of cash, cash equivalents and short-term deposits converted from RUB

using the exchange rate as of the end of the reporting period: RUB 70.3375 per

1 USD as of December 31, 2022 (source: the Central Bank of the Russian

Federation).