May 24, 2023 – Ozon Holdings PLC

(NASDAQ and MOEX: “OZON”, thereafter referred to as “we”, “us”, “our”, “Ozon”

or the “Company”), an operator of the leading Russian e-commerce platform,

announces its unaudited financial results for the first quarter ended

March 31, 2023.

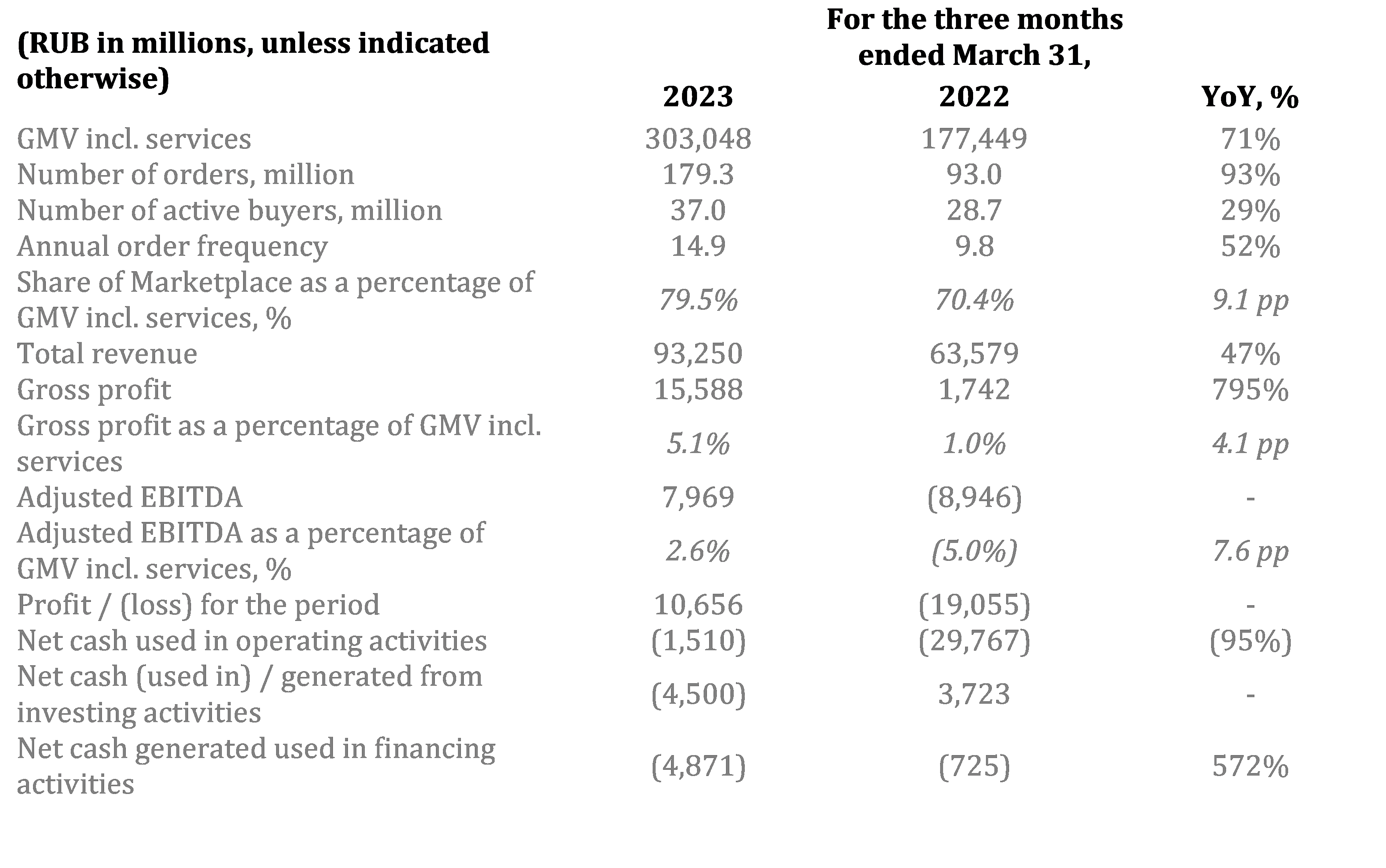

First Quarter 2023 Operating and Financial Highlights

- GMV incl. services increased by 71% year-on-year to RUB 303 billion, primarily driven by the strong performance of the Ozon Marketplace (3P), while growth in 1P GMV remained broadly flat year-on-year in Q1 2023. Growth in the number of orders accelerated to 93% year-on-year, driven by a larger customer base and a rising order frequency. Number of active buyers expanded to 37 million as of March 31, 2023. Order frequency per active customer almost tripled in the last two years and reached 15 orders per annum.

- Total revenue increased by 47% year-on-year, underpinned by strong service revenue growth of 120% in Q1 2023.

- Adjusted EBITDA was positive for the fourth consecutive quarter, reaching RUB 8.0 billion in Q1 2023, compared to negative RUB 8.9 billion in Q1 2022. Adjusted EBITDA as a percentage of GMV incl. services amounted to 2.6% in Q1 2023, marking a significant improvement of 7.6 p.p. year-on-year.

- Profit for the period was RUB 10.7 billion in Q1 2023 compared to a loss of RUB 19.1 billion in Q1 2022, primarily as a result of a one-off gain related to the extinguishment of financial liabilities and solid revenue growth.

The above table sets forth a summary of the key

operating and financial information for the quarter ended March 31, 2023. The

quarterly information for the three months ended March 31, 2023 and 2022 has

not been audited by the Company’s auditors. In Q1 2023, we revised the presentation

of the statement of profit or loss and other comprehensive income as described

in “Presentation of Financial and Other Information – Changes in presentation and reclassifications”. The

comparative information for Q1 2022 has been reclassified to comply with the

revised presentation. See

also the “Presentation of Financial and Other Information –

Other

Key Operating Measures”

section of this press release for a definition of non-IFRS measure, Adjusted

EBITDA, and a discussion of the limitations on its use, and reconciliations of

the non-IFRS measure to the applicable IFRS measure. See the definitions of

metrics such as GMV incl. services, number of orders, number of active buyers,

number of active sellers and share of Marketplace GMV in the “Other Key

Operating Measures” section of this press release.

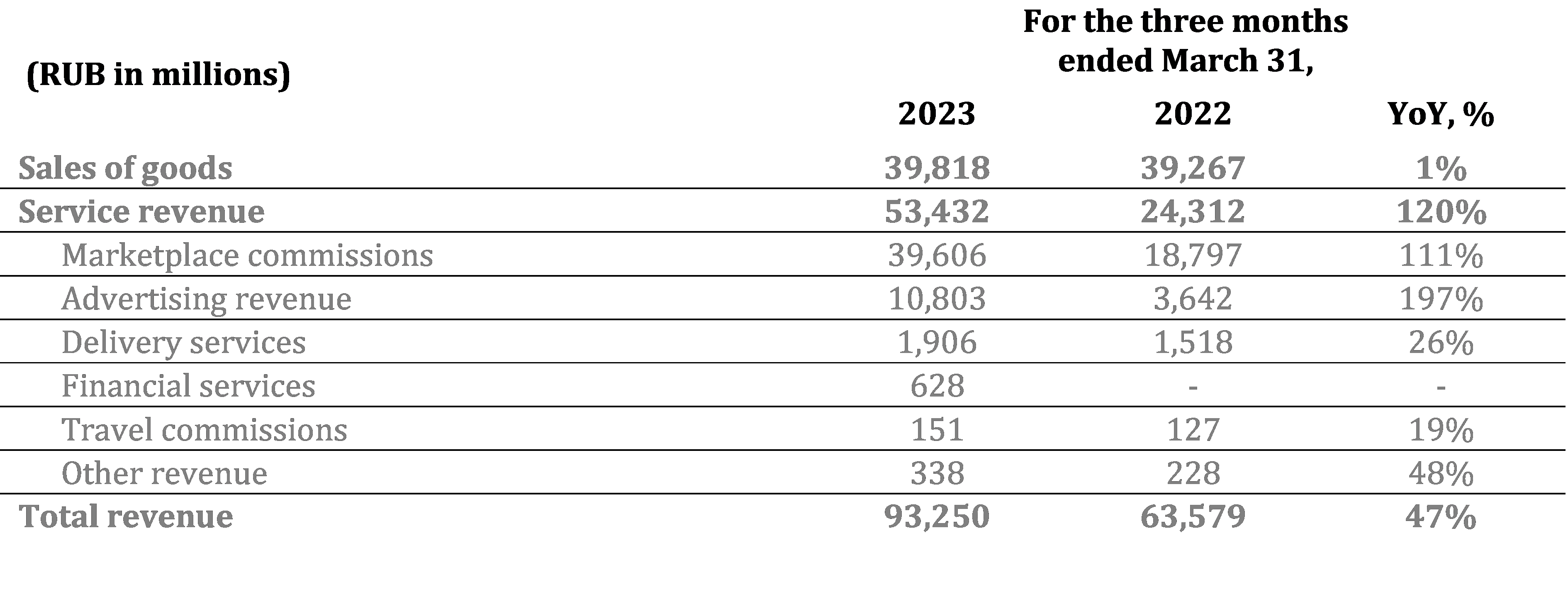

Total revenue grew by 47% year-on-year,

driven by a 120% increase in service revenue in Q1 2023. The increase in

service revenue was a result of rapid growth in advertising revenue as well as

greater marketplace commissions due to the positive mix effect and the growing scale

of our 3P business.

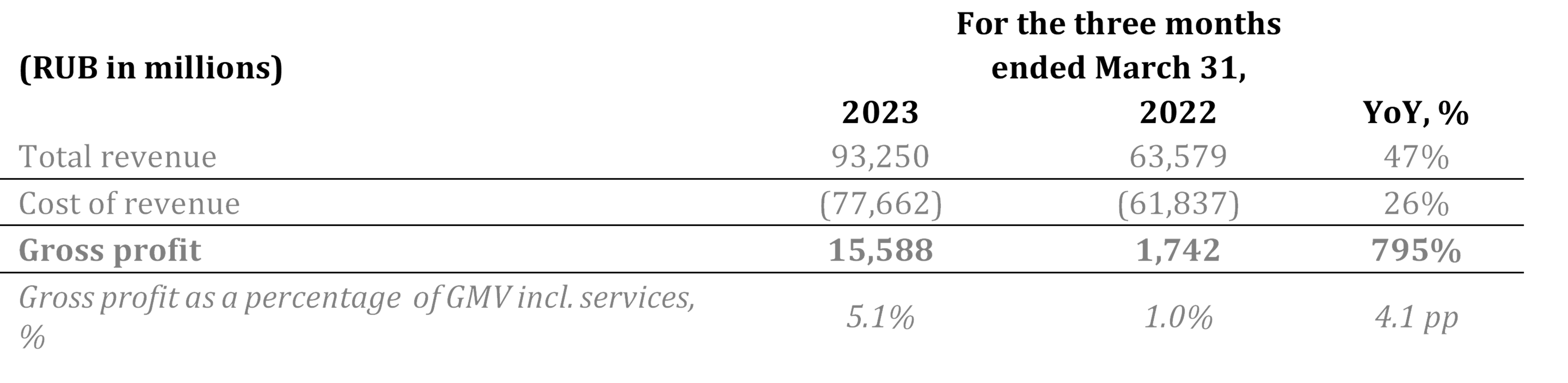

From January 1, 2023, as further described in the “Presentation of Financial and Other Information – Changes in presentation and reclassifications”, “fulfilment and delivery expenses” and “cost of sales”

have been presented as “cost of revenue”, following continuing fast growth in our

marketplace operations. Accordingly, we changed the definition of gross profit from total revenue less cost

of sales in a given period to total revenue less cost of revenue in a given

period.

Gross profit increased more than 9-fold year-on-year to RUB 15.6 billion. Gross profit as a

percentage of GMV incl. services was up by 4.1 p.p. year-on-year to 5.1% in Q1

2023, largely due to growth in service revenue and efficiency gains in

fulfilment and delivery.

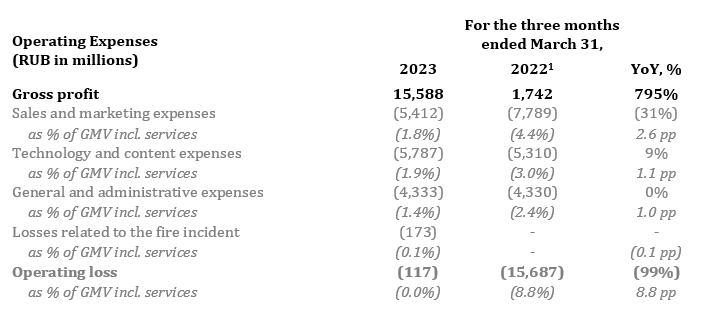

Operating expenses decreased to 5.1% as a percentage of GMV incl.

services in Q1 2023. Growing scale and cost optimization led to a significant

improvement in unit economics, as operating expenses declined significantly on a

per order basis in Q1 2023. In the aggregate, Sales and Marketing, Technology

and Content and General and Administrative expenses per order declined by 54% to

RUB 87 in Q1 2023 from RUB 187 in Q1 2022.

Profit for the period improved to RUB 10.7

billion in Q1 2023 compared to a loss of RUB 19.1 billion in Q1 2022, primarily

due to a one-time financial gain from the extinguishment of financial

liabilities.

Net Cash Used in Operating Activities decreased to RUB 1.5 billion in Q1 2023 versus RUB 29.8 billion in Q1

2022, as a result of changes in working capital as well as an improvement in

operating profitability.

Net Cash Used in Investing activities was RUB 4.5 billion in Q1 2023 compared to RUB 3.7 billion net cash

generated from investing activities in Q1 2022, as the release of bank deposits

fully offset higher capital expenditures in Q1 2022.

Capital Expenditures amounted to RUB 4.5 billion in Q1 2023 and were significantly lower

compared to RUB 15.4 billion in Q1 2022, when capital expenditures were

elevated by the accelerated purchasing of IT equipment.

Net Cash Used in Financing activities increased to RUB 4.9 billion compared to RUB 0.7 billion in Q1 2022, due

to the impact of the convertible bond restructuring in Q1 2023 and higher proceeds

from borrowings in Q1 2022.

Cash,

cash equivalents and short-term bank deposits amounted to RUB

82.4 billion (an equivalent of 1.1 billion in USD terms2) as of March 31, 2023,

compared to RUB 90.5 billion (an equivalent of 1.3 billion in USD terms3) as of December 31, 2022.

Risk and Uncertainties Related to Current Environment

The Company’s primary market of operations is Russia. The Company’s

business and the results of its operations are therefore dependent on the

economic conditions in Russia. Over the last two decades, the Russian economy

has experienced or continues to experience at various times significant

volatility in its GDP, high levels of inflation, increases in, or high,

interest rates, sudden price declines in oil and other natural resources and

instability in the local currency market.

The sanctions imposed on Russia and Russian persons by a number of

countries in connection with the geopolitical crisis surrounding Ukraine, along

with regulatory counter-measures taken by the Russian Government, have had a

significant, and in many cases unprecedented, impact on companies operating in

Russia. The United States, the European Union, the United Kingdom and other

countries imposed severe sanctions targeting Russian financial institutions,

oil, defense and other state-owned companies and other Russian companies and

businesspersons, as well as export and import restrictions. In response, Russia

identified a number of states, including the United States, all European Union

member states and the United Kingdom, as “hostile” and introduced a number of

economic measures in connection with their actions, as well as economic

measures aimed at ensuring financial stability in Russia.

As the potential global and economic impacts of the geopolitical crisis

surrounding Ukraine continue to rapidly evolve, in a manner that is unpredictable

and beyond the Company’s control, it is difficult to accurately predict the

full impact of the sanctions that have been introduced, as well as that of any

measures taken by the Russian Government in response to these sanctions.

Convertible Bonds

As a result of a “Delisting Event” in March 2022, the holders of our USD

750 million 1.875% senior unsecured convertible bonds due 2026 (the “Bonds”)

were entitled to require the Company to redeem the Bonds at the principal

amount together with accrued interest on the redemption date, which was May 31,

2022. In October 2022, holders of over 90%

in principal amount of the Bonds outstanding voted in favor of early redemption

of the Bonds (the “Restructuring”). The terms of the Restructuring can be found

in the consent solicitation memorandum dated September 23, 2022. By December

31, 2022, the Company obtained U.S. and Cyprus sanctions licenses regarding the

Restructuring, and in March 2023 the UK sanctions authority published a general

license the scope of which covers the Restructuring and its implementation. As

of the date of this press release, the Company has paid Cash Redemption Amount

to Bondholders holding approximately

94% in principal amount of the Bonds.

As of the date of this press

release, all of the Bonds outstanding are deemed

cancelled. For further disclosure related to the

Restructuring, please refer to the Company’s website https://ir.ozon.com/restructuring.

About OZON

Ozon is a multi-category e-commerce platform operating in Russia, Belarus

and Kazakhstan. Its country-wide fulfillment infrastructure and delivery

network enables Ozon to provide its customers with fast and convenient delivery

via couriers, pick-up points or parcel lockers. Its extensive logistics

footprint and fast-developing marketplace platform allow entrepreneurs to sell

their products across Russia’s 11 time zones and offer customers wide selections

of goods across multiple product categories. Ozon actively seeks to

expand its value-added services such as fintech and other new verticals such as

Ozon fresh online grocery delivery. For more information, please visit https://corp.ozon.com/.

Contacts

Disclaimer

This

press release contains forward-looking statements within the meaning of the

Private Securities Litigation Reform Act of 1995 that reflect the current views

of Ozon Holdings PLC (“we”, “our” or “us”, or the “Company”) about future

events and financial performance. All statements contained in this press

release that do not relate to matters of historical fact should be considered

forward-looking statements.

These

forward-looking statements are based on management’s current expectations.

However, it is not possible for our management to predict all risks, nor can we

assess the impact of all factors on our business or the extent to which any

factor, or combination of factors, may cause actual results to differ

materially from those contained in any forward-looking statements we may make.

These statements are neither promises nor guarantees but involve known and

unknown risks, uncertainties and other important factors and circumstances that

may cause Ozon’s actual results, performance or achievements to be materially

different from its expectations expressed or implied by the forward-looking

statements, including conditions in the U.S. capital markets, negative global economic

conditions, the geopolitical crisis surrounding Ukraine and sanctions and

governmental measures imposed in response, other negative developments in

Ozon’s business or unfavorable legislative or regulatory developments. We

caution you therefore against relying on these forward-looking statements, and

we qualify all of our forward-looking statements by these cautionary

statements. Please refer to our Annual Report on Form 20-F for the year ended

December 31, 2022 and other filings with the SEC concerning factors that

could cause actual results to differ materially from those described in our

forward-looking statements.

These

and other important factors could cause actual results to differ materially

from those indicated by the forward-looking statements made in this press

release. Any such forward-looking statements represent management’s estimates

as of the date of this press release. While Ozon may elect to update such

forward-looking statements at some point in the future, Ozon disclaims any

obligation to do so, even if subsequent events cause its views to change. These

forward-looking statements should not be relied upon as representing Ozon’s

views as of any date subsequent to the date of this press release.

This

press release includes “Adjusted EBITDA”, a non-IFRS financial measure not

presented in accordance with IFRS. These financial measures are not measures of

financial performance or liquidity in accordance with IFRS and may exclude

items that are significant in understanding and assessing our financial

results. Therefore, these measures should not be considered in isolation or as

an alternative to loss for the period or other measures of profitability,

liquidity or performance under IFRS. You should be aware that the Company’s

presentation of these measures may not be comparable to similarly titled

measures used by other companies, which may be defined and calculated

differently. See “Presentation of Financial and Other Information” in this

press release for a reconciliation of certain of these non-IFRS measures from

the most directly comparable IFRS measure.

This

press release includes interim financial information for the three months ended

March 31, 2023 and 2022. The quarterly information has not been audited by the

Company’s auditors.

The trademarks

included herein are the property of the owners thereof and are used for

reference purposes only. Such use should not be construed as an endorsement of

the products or services of the Company.

1 In Q1 2023, we revised the presentation

of the statement of profit or loss and other comprehensive income as described

in “Presentation of Financial and Other Information – Changes in presentation

and reclassifications”. The comparative information for Q1 2022 has been

reclassified to comply with the revised presentation.

2 The USD

equivalent was calculated as RUB amounts of cash, cash equivalents and

short-term deposits converted from RUB using the exchange rate as of March 31,

2023: RUB 77.0863 per 1 USD (source: the Central Bank of the Russian

Federation).

3 The USD equivalent

was calculated as RUB amounts of cash, cash equivalents and short-term deposits

converted from RUB using the exchange rate as of December 31, 2022: RUB 70.3375

per 1 USD (source: the Central Bank of the Russian Federation).